Barber Cost Of Goods Sold

Cost of Goods Sold COGS is the cost of a product to a distributor manufacturer or retailer. Other potentially deductible costs include labor assuming the labor was directly involved.

Mister Grooming Goods Pittsburgh Barbershop Men S Store Men Store Barber Shop Straight Razor Shaving

Mister Grooming Goods Pittsburgh Barbershop Men S Store Men Store Barber Shop Straight Razor Shaving

It entails all the expenses incurred in manufacturing or purchasing processing packaging and delivering a product.

Barber cost of goods sold. Uses the LIFO inventory costing method for both tax and financial reporting purposes. Things such as utility costs business supplies rent and equipment maintenance will need to be included in your operating budget. Youd want to make sure to add the purchase details of the inventory item used in the invoice.

State Market size by state reveals local opportunity through the number of companies located in the region. To calculate the cost of goods sold you must value your inventory at the beginning and end of the year. Sales revenue minus cost of goods sold is a businesss gross profit.

Cost of goods sold is the carrying value of goods sold during a particular period. Cost of goods sold formula. Assume all sales are for cash.

The next step down is Expenses. COGS Beginning Inventory Purchases During the Period Ending Inventory. As the barbershops are based on product and service model COGS also equate to cost of products and services sold or rendered.

This will be automatically generated in a transaction when using an inventory item. BEAUTY BARBER EXPENSES continued BUSINESS EQUIPMENT PURCHASED LEASEHOLD IMPROVEMENTS Calculator. Cost of goods sold is considered an expense in accounting and it can be found on a financial report called an income statement.

Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost BUSINESS EXPENSES cost of goods sold. The cost of goods sold for a business is essentially the amount of costs in a given period required to manufacture and sell the businesss goods. These are direct costs only and only businesses with a product.

Then you step down to Cost of Goods Sold. Costs of goods sold include the direct cost of producing a good or the wholesale price of goods resold. The balance sheet reports inventories at 297 million.

Youll likely also want to calculate the net income of your barber shop which is the total amount of money that remains after income taxes. Costs of Goods Sold COGS is one of the default accounts used by QuickBooks. All have different wage levels.

Then add the cost of what you purchased during the period. This way you can add its add material cost. Your beginning inventory is whatever inventory is left over from the previous period.

Target cost of goods sold for the twelve months ending October 31 2020 was 62748B a 147 increase year-over-year. Each line is a deduction from the income for retail purchases back bar purchases commissions paid and merchant fees. To find the cost of goods sold during an accounting period use the COGS formula.

So depending on who does what - t. Depending on the type of business the cost of. Assume that Barber Co.

We have barbers barber apprentices stylists and colourists. You will also need to budget for your first few months of overhead expenses. Cost of Goods Sold COGS is the total cost of acquiring and selling a product.

Cost of goods sold also includes all of your costs for making products storing them and shipping them to customers. The July 15 extension day for filing 2019 taxes has passed. PRODUCT SOLD SERVICE PERFORMED _____ How many months was this business in operation during the year.

Also referred to as cost of sales It is essentially a cost of doing business such as the amount paid to purchase raw materials in order to manufacture them into finished goods. Calculating the cost of goods sold COGS for products you manufacture or sell can be complicated depending on the number of products and the complexity of the manufacturing process. You are required to fill in the COGS in your business Profit and Loss statement and also the tax return.

Prepare the journal entries to record Net sales and Cost of goods sold for Kools for the fiscal year ended January 28 20X8. Cost of goods sold is the accounting term used to describe the expenses incurred to produce the goods or services sold by a company. The exact cost will vary depending on the state in which you operate but typically will cost no more than 300.

Cost of goods sold COGS is a calculation of the value of a companys inventory both that which has already been sold and that which remains to be sold. If you applied for an extension to October 15 2020 you must file your taxes by that date. Gross profit is the different of sales minus cost of goods sold while operating profit is the gross profit minus all other expenses.

A figure of cost of goods sold reflecting the cost of the product or good that a company sells to generate revenue appearing on the income statement as an expense. Target annual cost of goods sold for 2019 was 53299B a 425 increase from 2018. Target annual cost of goods sold for 2020 was 54864B a 294 increase from 2019.

Market size includes revenue generated from all products and services sold within the industry. Heres how to create inventory items. Barber Shops - Geographic Breakdown by US.

This will give you your Gross Profit which is the total money left after the Cost of Goods are subtracted. Another question that came through is if the hourly wage has been set for a barber and the service time is set why does the cost for that service not show.

The 1040 The Schedule C Part Iii Cost Of Goods Sold Taxes Are Easy

Cogs Worksheet Excel Template Cost Of Goods Sold Spreadsheet Cost Of Goods Sold Cost Of Goods Spreadsheet

Cogs Worksheet Excel Template Cost Of Goods Sold Spreadsheet Cost Of Goods Sold Cost Of Goods Spreadsheet

Initial Letter Ar Logo Template Design Stock Vector Royalty Free 1755804257 Artis Royalti Ilustrasi

Initial Letter Ar Logo Template Design Stock Vector Royalty Free 1755804257 Artis Royalti Ilustrasi

Browse Our Example Of Daycare Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Personal Budget Template

Browse Our Example Of Daycare Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Personal Budget Template

Hair Stylist Gold Script Beauty Salon Price List Rack Card Beautybrandssalon Beauty Salon Price List Salon Price List Hairdressing Salon Design

Hair Stylist Gold Script Beauty Salon Price List Rack Card Beautybrandssalon Beauty Salon Price List Salon Price List Hairdressing Salon Design

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

The Awesome Monthly Expense Report Template Daily Expense Record Week With Regard To Daily Report Sheet T Expense Sheet Report Card Template Monthly Expenses

The Awesome Monthly Expense Report Template Daily Expense Record Week With Regard To Daily Report Sheet T Expense Sheet Report Card Template Monthly Expenses

Barbershop Business Card Barber Pole Clippers Com Business Card Zazzle Com Barber Business Cards Salon Business Cards Barber Shop

Barbershop Business Card Barber Pole Clippers Com Business Card Zazzle Com Barber Business Cards Salon Business Cards Barber Shop

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Bookkeeping Business Business Tax Deductions Business Tax

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Bookkeeping Business Business Tax Deductions Business Tax

Multi Step Income Statement Template Awesome Multiple Step In E Statement Definition Explanation Income Statement Statement Template Profit And Loss Statement

Multi Step Income Statement Template Awesome Multiple Step In E Statement Definition Explanation Income Statement Statement Template Profit And Loss Statement

Free Statement Of Work Template Unique 17 Free Statement Of Work Templates Ms Fice Documents Statement Of Work Statement Template Templates

Free Statement Of Work Template Unique 17 Free Statement Of Work Templates Ms Fice Documents Statement Of Work Statement Template Templates

Profit Loss Statement Yearly Profit And Loss Statement Statement Template Income Statement

Profit Loss Statement Yearly Profit And Loss Statement Statement Template Income Statement

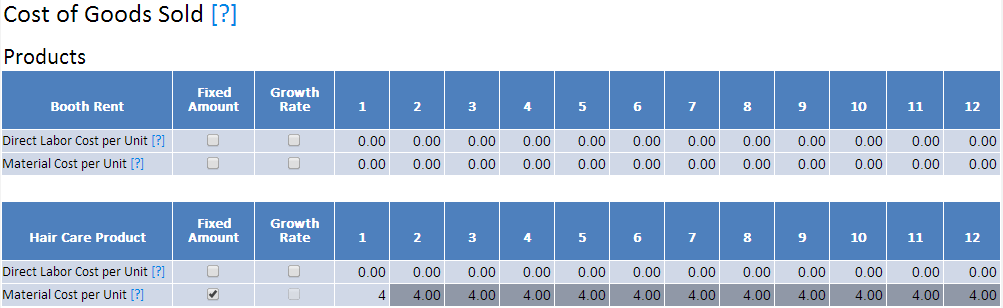

How To Make The Booth Rent Model Work For A Salon Or Barber Shop Projectionhub

How To Make The Booth Rent Model Work For A Salon Or Barber Shop Projectionhub

To Use In Your Small Business Or Nonprofi To Use In Your Small Business Or Nonprofit Accounting Ratios Bigez Com Non Profit Accounting Small Business

To Use In Your Small Business Or Nonprofi To Use In Your Small Business Or Nonprofit Accounting Ratios Bigez Com Non Profit Accounting Small Business

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Schedules Of Cost Of Goods Manufactured And Cost Of Goods Sold Cost Of Goods Sold Cost Of Goods Study Tips

Schedules Of Cost Of Goods Manufactured And Cost Of Goods Sold Cost Of Goods Sold Cost Of Goods Study Tips

How To Calculate The Cogs For A Service Company Quora

How To Create A Better Barber Shop Profit And Loss Statement Talus Pay

How To Create A Better Barber Shop Profit And Loss Statement Talus Pay